How much gold is there left to mine in the world?

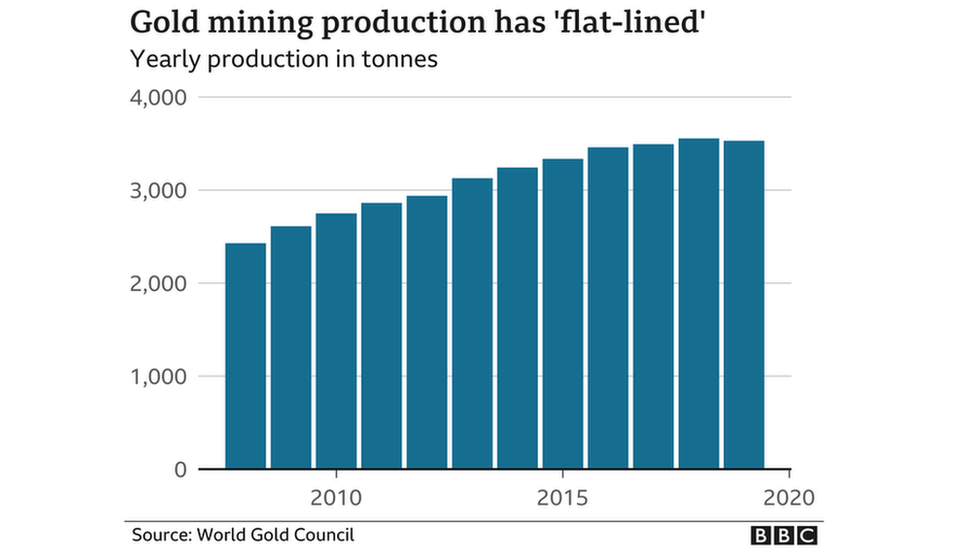

Gold prices have been on a tear this year. This has only partially been reflected on some of the Gold miners on the TSXV. Much of the price increase can be attributed to the fact that many existing mine reserves have been exhausted, or are approaching the end of their life. With the high grade deposits already mined, that leaves fewer high grade opportunities and increasing costs of extraction. The numbers would indicate that global supply has in fact flat-lined.

This article by the BBC talks about the reducing supply of gold reserves, and the realistic possibility of reaching peak gold.

Gold is in hot demand as an investment, a status symbol, and a key component in many electronic products.

But it’s also a finite resource, and there will eventually come a stage when there is none left to be mined.

Peak gold

Experts talk about the concept of peak gold – when we have mined the most we ever can in any one year. Some believe we may have already reached that point.

Gold mine production totalled 3,531 tonnes in 2019, 1% lower than in 2018, according to the World Gold Council. This is the first annual decline in production since 2008.

This coincides with the price increase of gold over recent periods. In fact, the chart below shows that since Nov 27, 2015, Gold has appreciated by 78.26%:

Silver has also seen similar appreciation in prices, and the same argument can very much be made there. The chart below shows a 71.79% appreciation in price over the same time period.

While we have talked abnout the Gold/Silver ratio and the fact that Silver may be overly discounted, what we find interesting right now is the diminishing supply of Gold mines. The TSXV is host to many mining companies, with a significant portion of them exploring Gold deposits.

We recommend purchasing a Gold stock near existing mines, and with the geological makeup scientific journals have identified as being host to bonanza-grade (>1 ounce per ton) deposits. One such stock is Tocvan Ventures (CSE:TOC).

We recently covered Tocvan Ventures and discussed their 2 projects, with particular interest in the Pilar project. Our valuation forecasts that TOC is worth north of $1.53! The geological makeup of the deposit is phenomenal. Other mines with this unique geological deposit have produed substantial Gold and Silver.

With supplies diminishing, it would be rational to invest a company with an asset that has the potential to deliver.

Those who missed our report, can read it below: