Reasons Copper prices have surged

Investors are capitalizing on Copper prices, which have seen a substantial rise recently. Copper started 2021 at its highest level in almost eight years, and increased by another 20% until the end of February 2021. According to S&P Global, it’s expected that this price surge will continue into the year.

London — A rise in the price of copper is likely to continue in 2021 on low inventories and a bullish demand narrative, though at a slower pace, industry analysts said.

This rise is another commodity being lifted by the rising tide of China.

Canaccord Genuity mining analysts expect Chinese stimulus to support copper demand in combination with an expected global economic recovery in 2021.

“We now expect copper prices to average $3.50/lb ($7716/mt) in 2021, an approximate 17% increase on our previous forecast of $3.00/lb ($6,614/mt),” Canaccord said.

Globally, the copper market is one of the biggest markets of all metals behind iron and aluminum, and the size of the global copper market is more than $150 billion every year. This is because copper is easy to work with, it is an efficient conductor of heat and electricity, it’s corrosion resistant, and it’s abundant. As a result, copper plays an important part in industrial production and is used extensively in the telecommunications and electronics industry.

As a result of this, there are a variety of factors that have influenced the recent rise in copper prices. These factors include supply, demand, pressure on commodity markets, current stockpiles, and general market activity. Many of these factors operate independently of the others and, as a result, much of the price variability that copper experiences is expected to continue in the long-term.

So, what has caused copper prices to rise so substantially in the recent months?

Copper Price Flashback

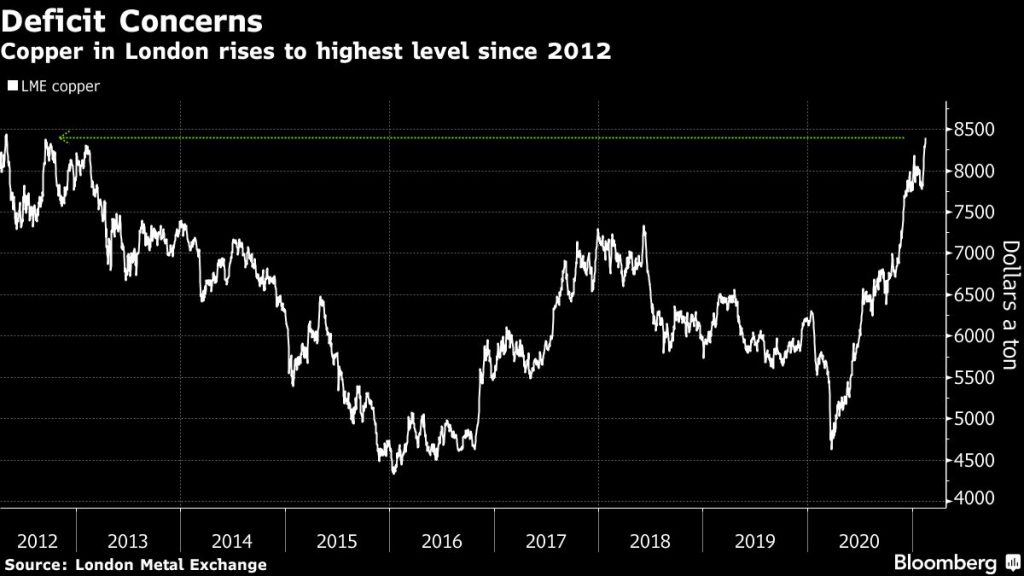

Before looking at the main reasons why the copper’s prices are rising sky-high, it’s necessary to look at a short history of recent copper price trends. It’s now trading at price levels it hasn’t seen since September 2011. During the period November 2010 to September 2011, copper traded at consistent highs of $4.50 per pound.

After reaching this high in September 2011 it dropped down to a low of just over $2 per pound in 2016. Since then, it has hovered in the $2 to $3.30 per pound price range until the beginning of the COVID-19 pandemic.

When the pandemic started in March 2020, Copper, much like many other commodities, surged in price. That leads us to today where it is currently trading around the $4.10 per pound region.

With all that said, what were the top reasons that led to the surge in copper’s price?

Economic Activity

Copper is often referred to as ”Dr. Copper” to describe its correlation to developments in the global economy. It’s used widely within the manufacturing sector and is also turned into products that end-users use like pipes, tubes, wires, and electronics. Also, it’s an effective and efficient conductor of heat and electricity, so it’s often used in the installation, energy, telecommunication, and construction sectors.

For this reason, the copper price has a strong correlation to the world economy. Here, trends in the Chinese economy play a major role while trends in the US and EU contribute to a lesser extent. Because China is the largest user of copper and accounts for 46% of the global consumption of the metal, its economy is a key factor in the copper price.

China’s economy grew by 2.3% in 2020. Although it was the lowest rate of growth since the 1970s, it’s also a welcome surprise considering that the world experienced its worst economic shock in recent memory. It’s economic recovery after the pandemic means that the demand for copper is so high that their copper inventories are at their lowest level in nearly ten years.

Also contributing to the prices remaining high, and possibly increasing, is the fact that the full reopening of the US economy is in sight and that the new Biden administration wants to invest heavily in America’s infrastructure. With the ink barely dry on the $1.9 trillion stimulus, another $2 trillion has been proposed and the Democrats plan to fast track passing the bill for this.

According to Commodity Market Analytics, the Biden administration will have a bullish impact on copper and its pursuit of a greener agenda will encourage more renewable power and electric vehicle development which will, in turn, boost copper demand.

CRU is expecting China to see growth in refined copper consumption of around 2 percent in 2020.

“The most recent Chinese macroeconomic data is generally robust, with monthly real estate completions turning positive,” Durant said. “For 2021, we think that stimulus measures, a recovery in the automotive sector and a buoyant construction market can again help power Chinese refined copper demand growth to over 2 percent year-on-year.”

Demand

Copper demand was significantly affected during the first quarter of 2020 with some estimating that the Chinese demand fell by as much of as 25% during that time. China started to go into an economic recovery during the second quarter of the year which led to a rebound in copper’s price. This rebound then continued throughout the third and fourth quarters when copper’s price reached a new high.

This demand is expected to continue, and some analysts speculate that there might even be a slight increase in Chinese demand for copper which has helped to drive prices higher in recent months. Although demand for copper in other parts of the world will still be lower than 2018 levels, it’s expected that vaccine approvals and roll-outs will allow economies to open up and the price of copper could increase.

Supply

According to Bloomberg intelligence, assuming their scenario of 5% demand growth is correct, and considering production guidance from the top 25% copper producers in the world, the copper market may be in for a sizable deficit this year.

At this stage, mined supply of the metal appears to be more than 400,000 tons shy of Bloomberg Intelligence’s estimates, which suggests that there will be a shortfall of supply close to 500,000 tonnes.

Likewise, StoneX, predicts that copper demand in 2021 will rise about 5% year-on-year, outstripping supply which they expect will grow by 2.3% year on year.

If these predictions are correct, it means that the copper supply will move from a small surplus in 2020 to a potential deficit of more than 200,000 tonnes in 2021. In fact, in some areas of the copper market, the supply of the commodity is at its lowest level in years.

This combined cocktail of increased demand and less supply provides support for a stronger copper price in 2021.

Sustainable Energy

The increase in copper demand is also due to the sustainable energy generation and consumption agenda which forms part of the green energy drive by governments. If one considers all the metals used in electricity generation, storage, and consumption, copper is the common denominator, and all these require copper.

Because it’s a highly efficient conductor of electricity and heat, it is often used in renewable energy systems to generate power from solar, hydro, thermal, and wind energy. This, in turn, increases the demand for copper because these projects are on the rise.

This brings about a long-term demand for copper which gives the price surge long-term market support. In fact, Polish copper producer KGHM opted to abandon their plans to close their operations when the COVID-19 pandemic first hit, and to rather focus on maintaining their output levels as a result of the demand of copper in green energy projects.

They project that in three to five years, the demand for copper could be even higher because of projects related to green energy, electromobility and new technologies. This demand will also be bolstered by the new US administration’s pledge to join a push for less pollution in energy generation.

This sentiment is also echoed by Bank of America who believes that the increased focus on tackling climate change will lead governments to focus their spending on decarbonization. This, in turn, is bullish for copper.

US Dollar

Because copper, like most other internationally traded commodities, is priced in U.S. dollars, there is a direct correlation between the value of the US dollar and the price of copper.

In simple terms, this means that a decrease in the value of the US dollar relative to a buyer’s local currency, would mean that the buyer would have to spend less to buy a given amount of copper. So, as copper becomes less expensive for these buyers, the demand goes up which results in an increase in the price.

A weaker dollar has another effect, though. It acts as a disincentive to copper producers to increase output. This means, as the dollar weakens, it reduces a producer’s profit margins. When these profit margins reduce, producers are less likely to increase their output, which means lower supply.

And, true to form, if one has regard to the dollar price, it has been in a steady decline since April 2020, the same time that copper prices started to surge.

In a sense contributing to this is the fact that copper can be a really good hedge against inflation. For example, both the US and China used monetary and fiscal stimulus to counter slower economic activity, which will enable them to show economic growth during 2021.

For these stimulus packages, governments all over the world were printing money which, in turn, causes inflation. Because copper is a good hedge against this inflation, it’s going to perform well in a reopening economy.

The Bottom Line

Copper has been one of the strongest performing commodities in the past year. Its price reached the highest levels it has seen in the past eight years, and it’s expected that this strong performance will continue well into 2021.

For investors, it’s simple. As the prices of copper spot and futures contracts rises, so does the profitability of producers, and, by implication, their stock price. Ultimately, this means that now might be a good time to invest in copper stocks, especially copper penny stock that gives investors the perfect opportunity to diversify their portfolios and increase their return on investment.

How to Profit

With the rise in copper prices, a phenomenal approach would be purchase the suppliers of these mines. Mines rich in copper is a sure way to profit, and so long as the mine is economic, the stock will appreciate. We remain very bullish on Etruscus Resources (CSE:ETR), not only because they recently found the highest copper grades in their property to date, but because their deposit is rich in other metals such as Silver and Gold.

Notably, Etruscus has cut 5.2% copper (the highest copper grade ever recorded in drilling at Black Dog) and 120 g/t silver over 0.60 meters (“m”) within a broader 3.8 m interval grading 1.15% copper and 27 g/t silver. This “feeder zone” mineralization also has highly anomalous gold, lead and zinc in drill hole RR20-09, starting at a downhole depth of 101.2 m.

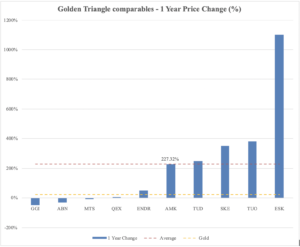

The company recently issued a press release showing the unbelievably massive potential they have in their property (link), and is the cheapest mining stock in the Golden Triangle by market capitlization. Similar stocks have seen their prices increase north of 2.2x in 2020.

For those who haven’t read it yet, the stock is currently trading at 34 c but is worth north of $1.00. You can see the full analyst report on Etruscus Resources here for free: https://www.tsxvresearch.com/research/etruscus-etr/